Chronicles Defi 2021: What are the prospects of "financial lego"

In 2021, the Defi segment continued rapid growth. Against the background of problems with the scaling of Ethereum, many alternative protocols and solutions of the second level, offering quick and inexpensive transactions have appeared.

The active development of the segment has opened new uskes: fixed profitability protocols, algorithmic stablecoins, concentrated liquidity managers and decentralized indices. Gained popularity "Concept Defi 2.0 ", focused on capital efficiency, stability of the native token and the construction of close -knit communities.

Forklog summed up the main aspects and development trends of Defi in 2021, focusing on the future prospects of the segment.

Key

- The Defi sector is continuously growing – new, often quite difficult projects for understanding, appear. Many of them involve interaction with different protocols and decisions of the second level.

- Algorithmic stabiblcoins, wrapped assets, profitability aggregators and a solution oriented towards a solution like Tornado Cash received a powerful impulse for development.

- Despite the abundance of new products, lending and decentralized exchanges remain key elements.

Makrovzglygs

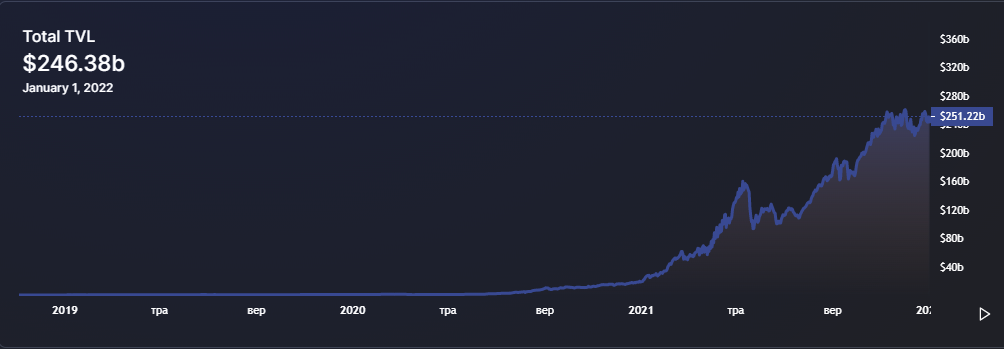

The total cost of funds blocked in Defi protocols (TVL) has increased by more than 10 times since the beginning of the year-from $ 18.65 billion to $ 246.38 billion (as of 1 by 1.01.2022).

Despite the rapid development of the structured products of the “financial lego”, most of the users are concentrated in relatively simple DEX lingering protocols and liquidity pools on the basis of AMM .

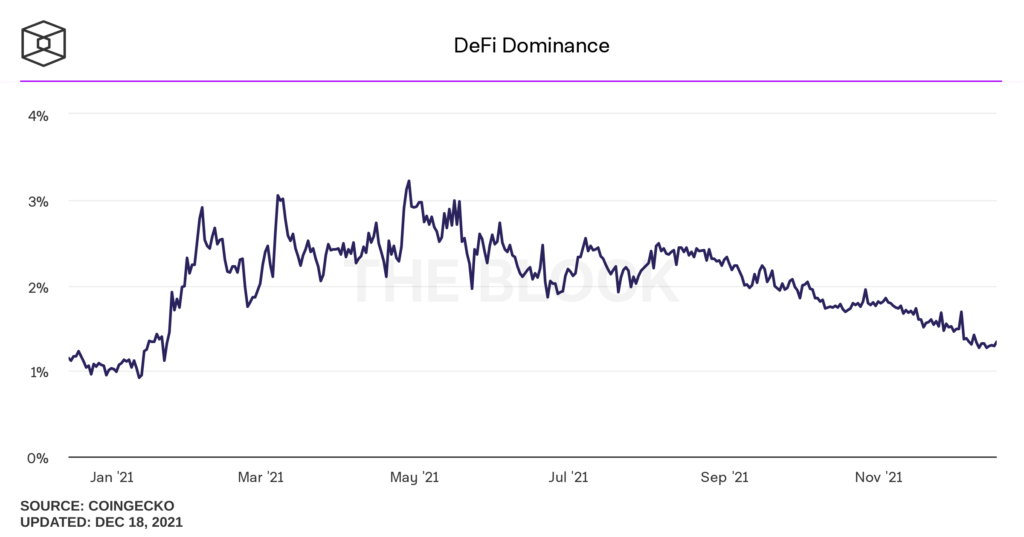

The total capitalization of Defi tokens regarding the indicator of the entire cryptocurrency market is still insignificant-below 1.5%. However, this may indicate the significant potential of the growth of the sector.

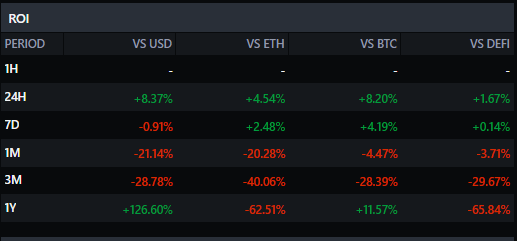

Defi Pulse Index (DPI), consisting of “blue chips Defi” (AAVE, BAL, UNI, MKR, COMP, etc. D.), most of the year ahead of the growth of bitcoin, yielding to Ethereum.

ETH prices in 2021 are largely owed to the development of Defi. This is due to the fact that the second one according to cryptocurrency capitalization is used to pay for gas. And the higher the activity in the sector, the greater the demand for ETH.

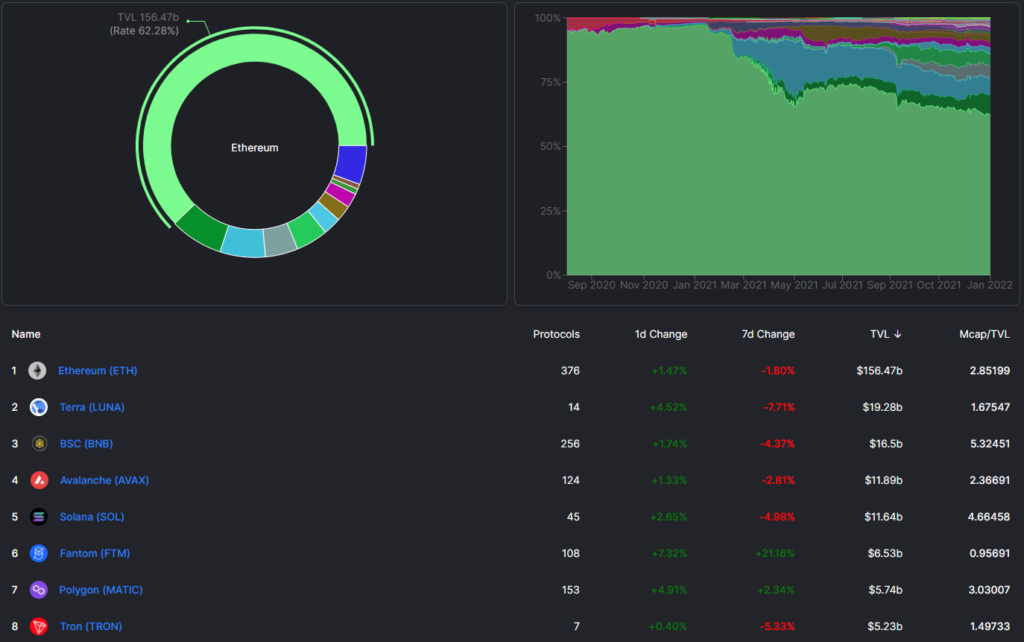

Ethereum is still the basis of Defi, however, alternative ecosystems like Binance Smart Chain (BSC), Terra, Avalanche, Solana, Polygon and Fantom are confidently gaining popularity.

The re-traffic between the protocols is facilitated by cross-marks. Thanks to them, users freely transfer funds to platforms based on various technologies, choosing pools with higher profitability indicators.

Decentralized exchanges

A key role in the Defi sector is played by the Uniswap decentralized exchange, which was one of the first to introduce and popularized the mechanism of automatic market maker.

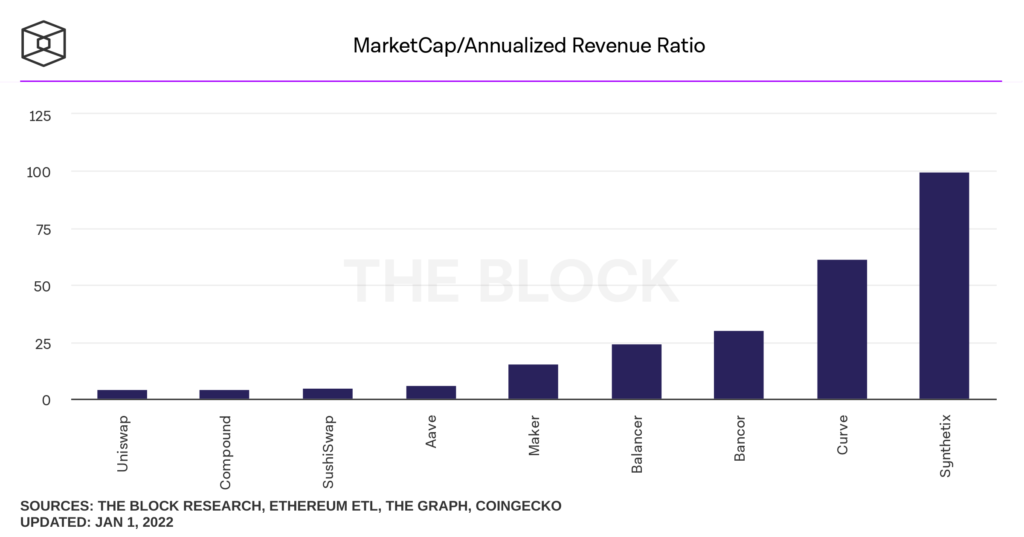

Along with Sushiswap, Uniswap is one of the lowest ratio capitalization/income. This suggests that the protocol is actively used, generates stable income and that UNI is unlikely to be overestimated.

In the second half of the year, the Curve platform, which supports many networks, was ahead of Uniswap on TVL. Competition with Pancakeswap, the largest DEX ecosystem, Binance Smart Chain has also intensified.

However, the new Uniswap growth driver can be its integration with the Polygon protocol, which in early October bypassed Ethereum in the number of active addresses.

🗳 The Uniswap Community Has Voted to Deploy V3 On @0xpolygon Through The Governance Process.

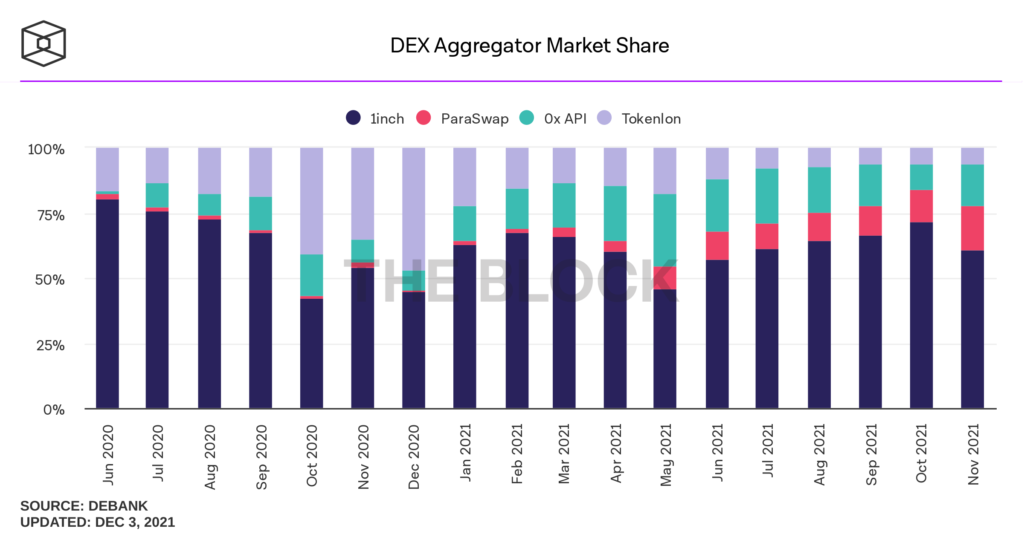

Among users, liquidity aggregators with DEX are popular, among which 1inch leads.

However, the market share of the Paraswap platform is growing, which in November conducted a somewhat controversial Eirrod of Native Token.

Landering protocols

Lending protocols remain one of the main components of Defi. They allow you to receive passive income on invested funds and borrow cryptoactives (mainly stablecoins) under the percentage acceptable by the standards of developing markets.

In the top three largest landing protocols (as of 2.01.2022) includes:

-

from TVL $ 14.4 billion, supporting Ethereum, Avalanche and Polygon;

- Anchor ($ 9.04 billion) based on Terra; ($ 8.85 billion) – veteran of the segment based on Ethereum.

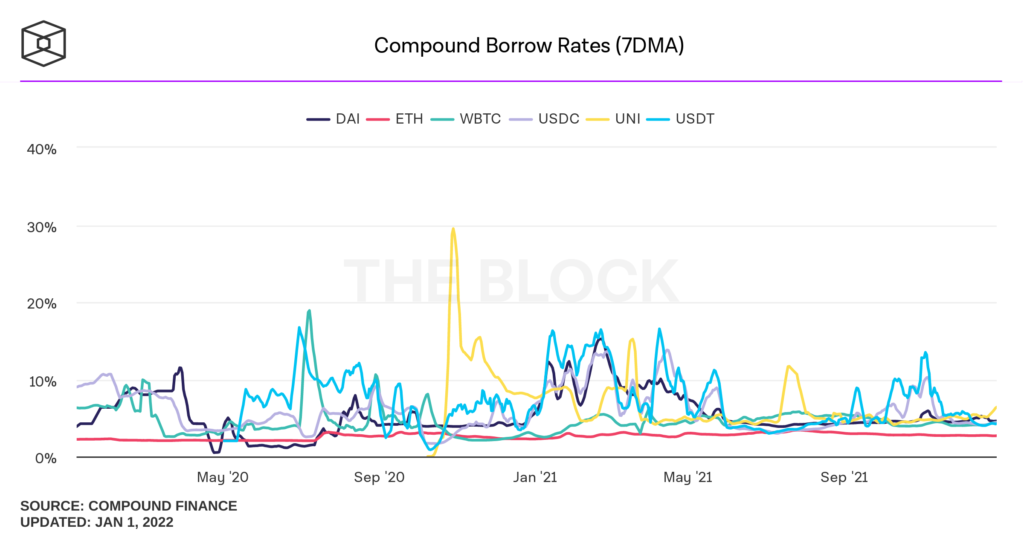

The schedule below shows that against the background of market growth at the beginning of the year, the lending rate on Compound were relatively high and volatile.

As the market “cools” by the middle of the year, the volatility has decreased by the middle. It is also noticeable that stable lending rates are much higher than that of ETH, WBTC or UNI.

In the cryptocurred sector, classic platforms dominate, offering “super -bass” loans . However, the protocols of the new generation like Alchemix and Abracadabra are gaining popularity. They are focused on higher capital efficiency and minimization of liquidation.

Protocols with fixed rates are gradually developing, but the share of such products on the market is still small.

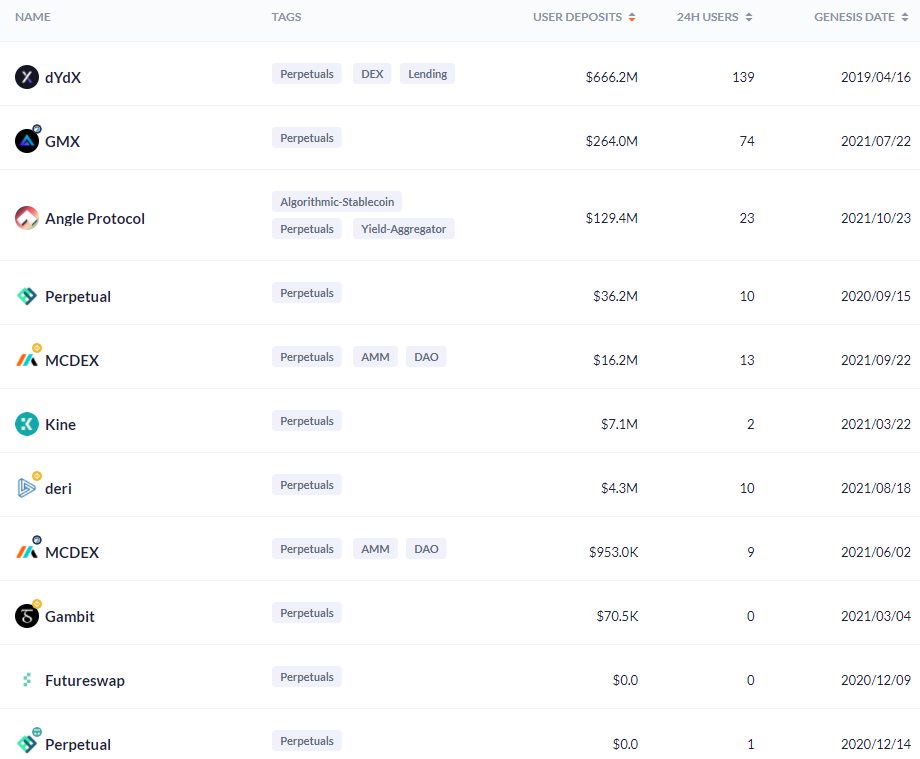

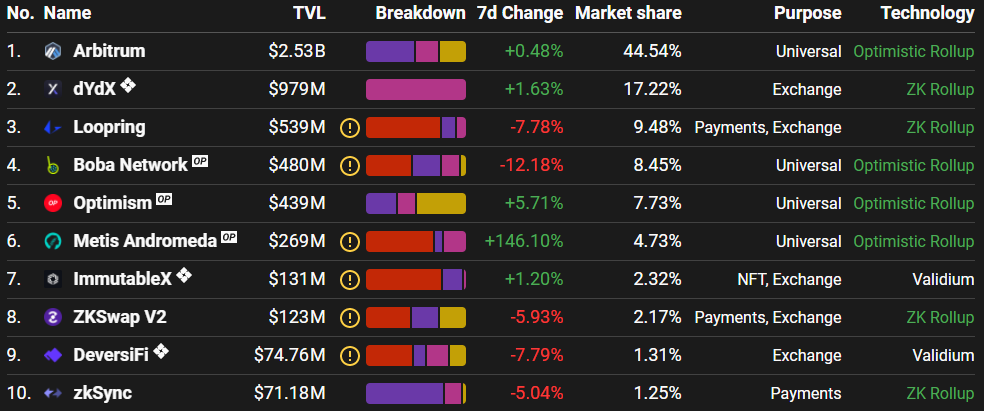

Dydx also holds leading positions on TVL among second -level solutions.

The success of the platform was largely facilitated by the generous Airrod and the preceding it of the launch of unlimited swaps in the second -level protocol. In September, Dydx went around Coinbase in terms of trading, repeating the success of Uniswap.

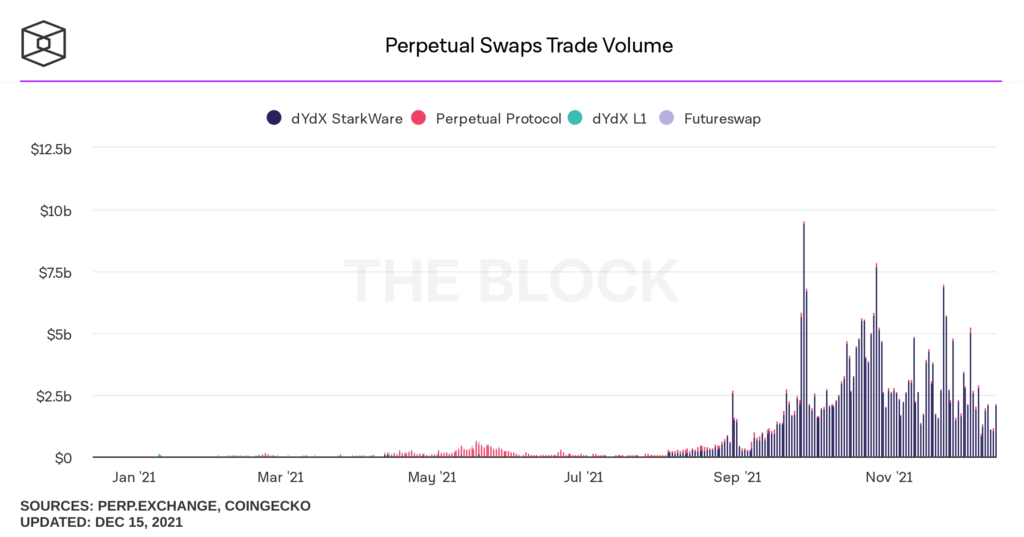

The graph below shows that among cryptoderivative platforms in May dominated Perpetual Protocol. However, in August, Dydx captured leadership.

The trend that began in the fall to reduce the revolutions Dydx, Perpetual Protocol and Futureswap and began in the fall.

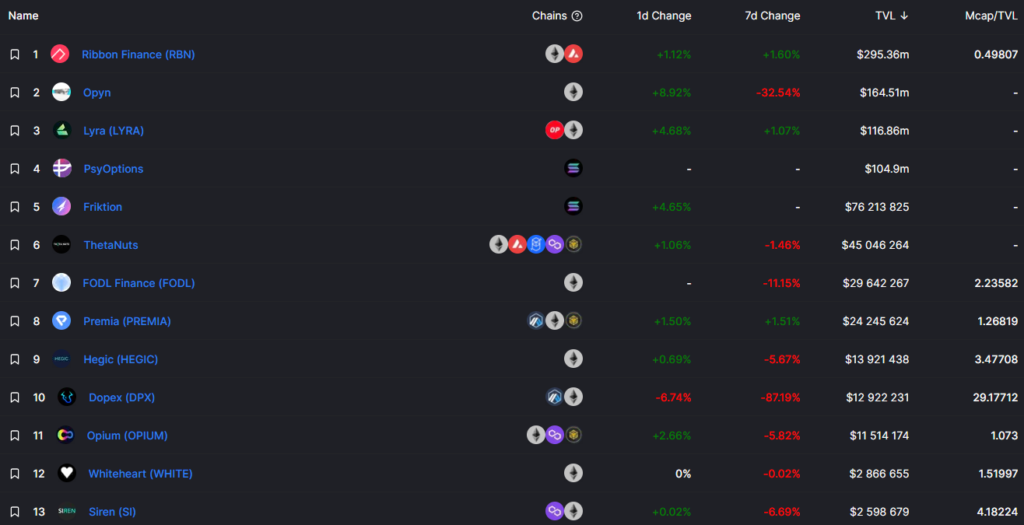

Relatively small TVL indicators in the protocols of decentralized options. The three leaders of this sector include Ribbon Finance, Opyn and Lyra.

Decentralized options – albeit rather complex, but interesting tools. Advanced investors they open new strategies, and projects – wide opportunities for integration.

The interfaces of some platforms can not yet be called friendly in relation to the user. It is also obvious that many services are lacking in liquidity.

Nevertheless, decentralized options are a logical stage in the development of crypto industry and Defi. These platforms have yet to achieve maturity and justify themselves as effective hedging and speculation tools.

Structured products

As Defi develops, more advanced tools appear, including second -order protocols. This category includes projects-building buildings over other services. Such platforms are designed for:

- automation of certain functions;

- increase in profitability, for example, due to compounds;

- expansion of the functionality of basic platforms.

The CONVEX FINANCE revenue aggregator leads in the sector. The protocol launched in May reached $ 20 billion.

Convex Finance – is a decentralized stake service based on Curve. Thanks to him, liquidity providers can increase the profitability of stakeing without blocking CRV tokens.

Yearn Finance from the notorious Andre Kronya is one of the first yield aggregators in Defi. However, its TVL at the end of 2021 is much smaller than that of Convex Finance – “total” $ 5.69 billion.

Tranches has gained considerable popularity in the second half of the year, offering structured products for investors with various risk tendency. Among the BSC platforms, the project takes 3rd place on TVL.

A separate category includes optimizers of concentrated liquidity positions like Charm, Gelato and Popsicle Finance. Such platforms are designed to increase the profitability of liquidity providers on Uniswap V3 and reduce the risks of inconsistent losses.

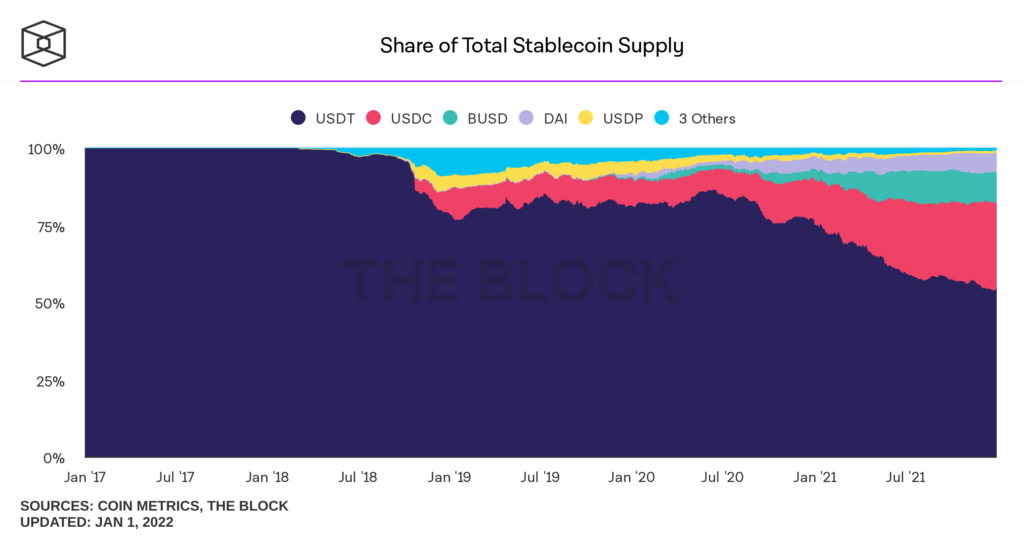

Centralized steablecoins have regulatory risks and risks of the counterparty. So, the US Senate in September announced the need to complete “stable coins” in cash and their equivalents, as well as the feasibility of regular audits.

The risks of the counterparty are that users are forced to trust the issuer, relying on the fact that the tokens produced by him are provided with reserves by reliable castean.

DAI tokens actually are a debt secured by a debt to MakerDao. Such a system is characterized by low capital efficiency, since the key always exceeds the size of the loan. In other words, to generate a certain amount of DAI, you need to freeze a much larger amount in other cryptoactives.

In response to the regulatory risks and inefficiency of centralized and super -bastard stablecoins, algorithmic “stable coins” began to appear.

Projects, which are something like automated central banks, use algorithms for flexible management of assets supply and underlying them with the economy.

The indisputable leader in this sector is the LUNA token stabbleko UST from the Terra project. Unlike many other algorithmic stablecoins like AMPL, BAC or BAC, a characteristic high capitalization (more than $ 10 billion) and the stability of the course for UST.

However, even UST sometimes loses its price attachment to the basic asset. For example, against the background of the May collapse of Luna, Stablecoin’s course sank by 3.8%, but after a couple of days restored parity with the American dollar.

Thanks to the development of the ecosystem and high demand for stablecoin from Terra, Native Token Luna fixed on the 9th line of the ratings of market capitalization, leaving behind Avalanche, Polkadot and Dogecoin.

In addition to stabilcoins, the so -called “low -coal tokens” like RAI from Reflexer and OHM from Olympus DAO also develop. Capitalization of the latter exceeds $ 2 billion. The peculiarity of such assets is to regulate the proposal of tokens during periods of sharp fluctuations in demand.

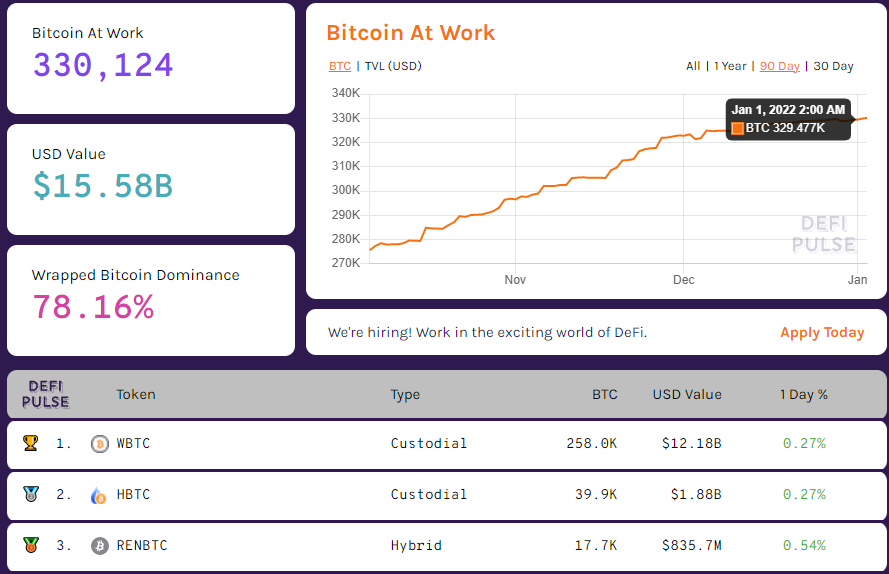

The segment of tokenized BTC also continues to grow. Their proposal from the beginning of the year has grown from 140,000 to 329,477 (as of 1.01.2022). This is 1.74% of the market supply of bitcoin. The total capitalization of Bitcoins on the air exceeds $ 15 billion.

The share of the indisputable leader of the segment – Wrapped Bitcoin (WBTC) – is 78.16%. A significant part of the WBTC proposal is blocked in the landing protocols of Maker, Compound and AAVE as security for loans.

BTCB has gained significant popularity in 2021-the BEP-20 Standard (Binance Smart Chain). In the first half of November, its market capitalization exceeded $ 7 billion.

More than 10% of the BTCB offer is blocked in the Venus landing protocol. The latter TVL is about $ 2 billion. BTCB also plays a key role in the TRANCHESS project with TVL more than $ 1 billion.

Developing segments

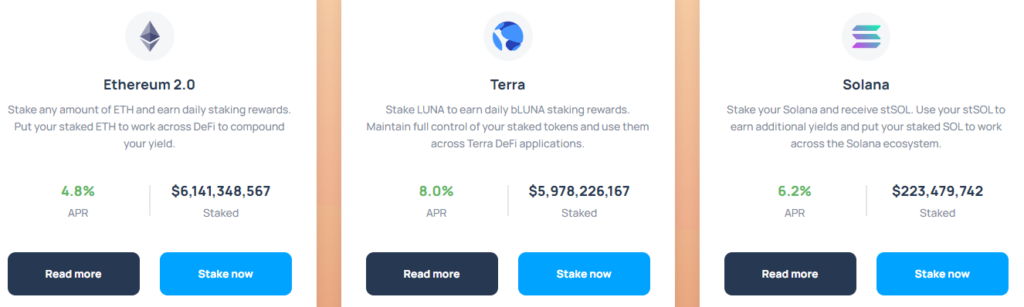

December 1, 2020 launched the zero phase Ethereum 2.0, which has become the starting point for the gradual transition of the broadcast to the consensus algorithm Proof-OF-STAKE. Users have the opportunity to make ETH to a deposit contract, becoming validators or delegating funds to other network participants.

From the moment the deposit contract is launched, users have sent 8.86 million ETH to the new system. As of 2.01.2022 they are estimated at ~ $ 33.28 billion.

Liquid staying

Together with the launch of a deposit contract, there were solutions for liquid stakeing. One of the largest such services-LIDO-offers the opportunity to unlock the ETH coins involved in the stake for their use in Defi applications. To do this, the project uses the Native STETH token, representing a tokenized version of coins involved in the Ethereum 2 ecosystem.0.

The total value of the assets involved in LIDO exceeds $ 12 billion. In addition to Ethereum 2.0, the service allows you to steak LUNA to obtain Bluna with an annual yield of 8%. You can also block the SOLANA cryptocurrency to get STSOL.

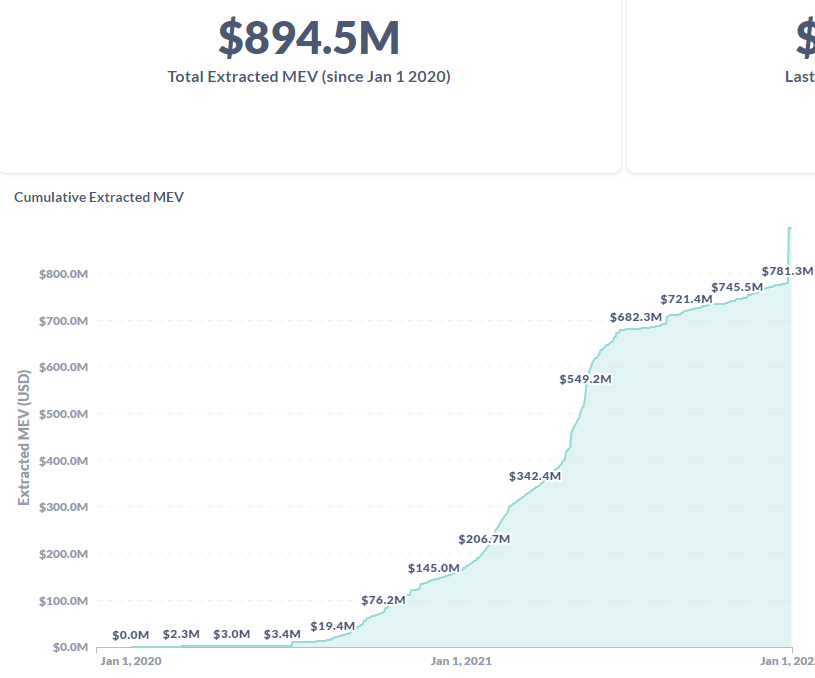

Miner Extractable Value (MEV)

Among other things, the concept of Miner Extractable Value (MEV) was developed, which is sometimes called an “invisible tax in Ethereum”.

In the structure of revenues from MEV, more than 97% falls on arbitration operations using many DEX liquidity bullets. The remaining 3% – liquidation strategies and their combinations.

Various services have appeared, designed to minimize the loss of market participants due to MEV. Among them:

- Decentralized CoESWAP exchange based on GNOSIS PROTOCOL V2;

- Keeperdao protocol, using a private virtual membrane called Hiding Book;

- SECRET SWAP cross-platform based on AMM;

- The Backrunme tool, which allows you to carry out confidential transactions resistant to front-line and “sandwich-atams”;

- Taichi Network – a service of private transactions running the SPARKPOOL pool;

- MistX.IO from Alchemist – DEX, working on the basis of technology from Flashbots.

- Fair Sequencing Services MEV from the ChainLink project.

Privacy

Tornado Cash is one of the most popular Ethereum Mixers. The service of the service for the year increased from $ 55.5 million to $ 588 million (as of 2.01.2022). The peak of the indicator was reached on October 21 at $ 1.17 billion.

The popularity of the service was facilitated by the Torn Native Token, as well as integration with the second level of Arbitrum. Recently, the Tornado Cash team has launched a nova pool, which allows you to deposit and display arbitrary amounts of ETH.

Insurance

This is one of the few Defi sectors that demonstrated unconvincing dynamics.

A significant share of the market in this sector is occupied by two protocols – Armor and Nexus Mutual. TVL each of the $ 600 million is close to the mark (as of 2.01.2022, which is very little in comparison with the leading DEX and landing protocols.

In Nexus Mutual, the volume of insurance coating reached a peak in February at $ 2.3 billion. As of 1.01.2022 The indicator is $ 651 million. The decrease from the peak mark was 71.7%.

In 2021, decentralized autonomous organizations (TAO) continued to develop.

Any organization has a set of certain rules. A set of TJ rules is encoded in the form of an unchanged part of the software called a smart contract. The latter operates on the base of the blockchain and is the basis of the Tao.

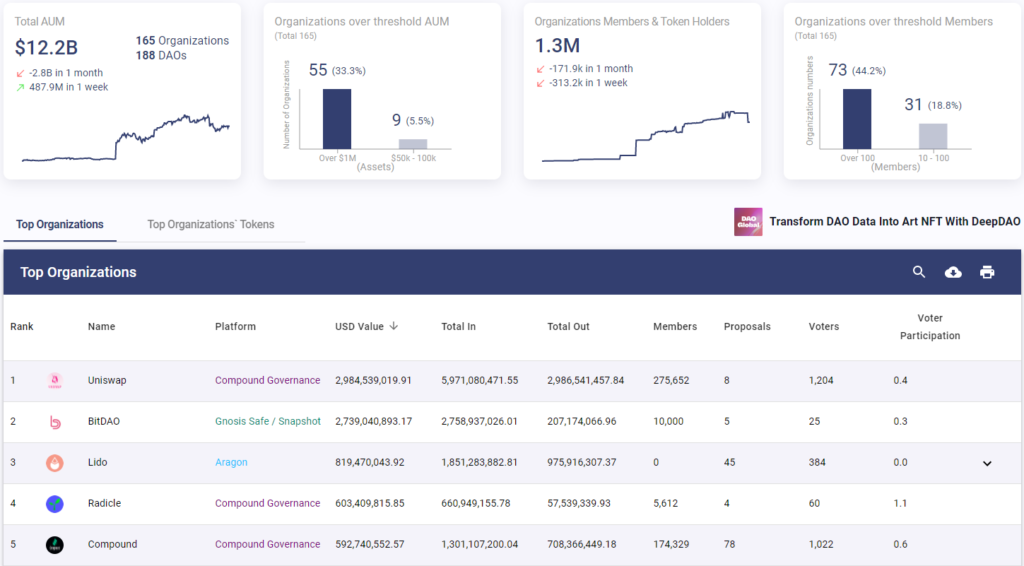

According to the DeepDao service, the total amount of funds running 187 decentralized autonomous organizations is $ 12 billion.

In the top three, the largest Tao in terms of total cost includes (as of 2.01.2022):

- Uniswap (>$ 2.9 billion);

- Bitdao ($ 2.7 billion);

- LIDO ($ 819.4 million).

The total number of participants in TAO is 1.3 million.

The attackers are not asleep

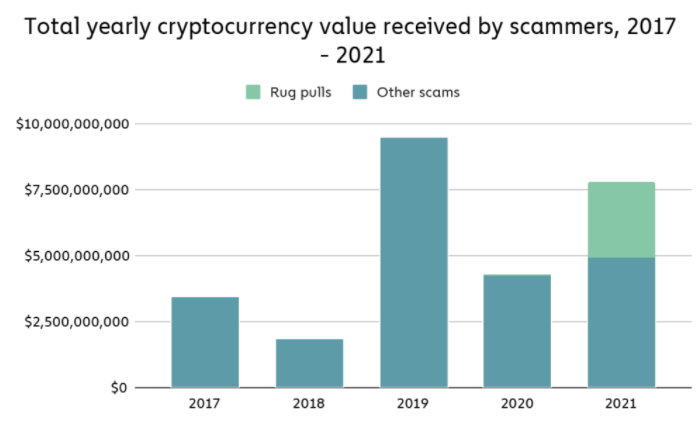

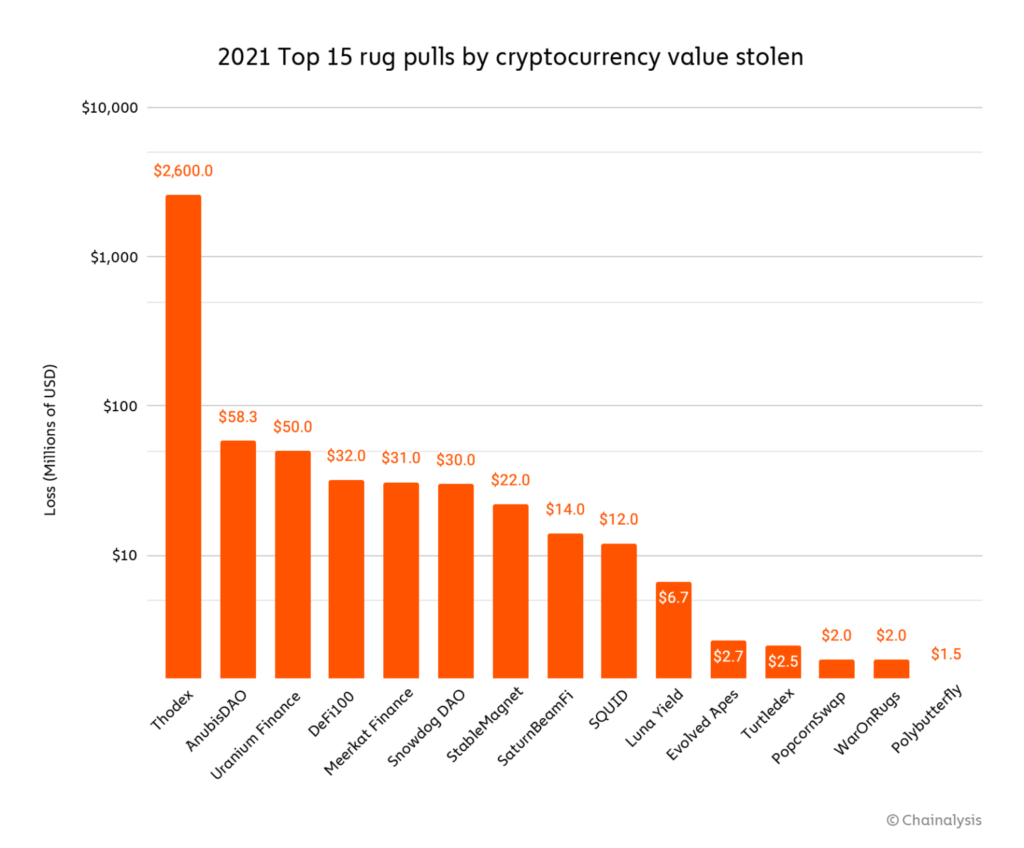

According to Chainalysis, in 2021 scammers stole more than $ 7 https://gagarin.news/ru/news/tightening-taxes-on-digital-money-in-india/ .7 billion in cryptocurrencies among users. Over a third of this amount fell on the so -called Rug Pull .

The number of cybercressions on cryptornka increased by 81% compared to 2020.

In the Defi ecosystem, the Rug Pull scheme has actively spread, which brought to attackers over $ 2.8 billion. This is 37% of all income from cryptocurrency fraud compared to only 1% in 2020.

Chainalysis recommended users to avoid new tokens that did not pass the audit code.

conclusions

Defi is continuously developing, new protocols, second-level solutions and cross-bridges appear. This contributes to the influx of funds in the ecosystem.

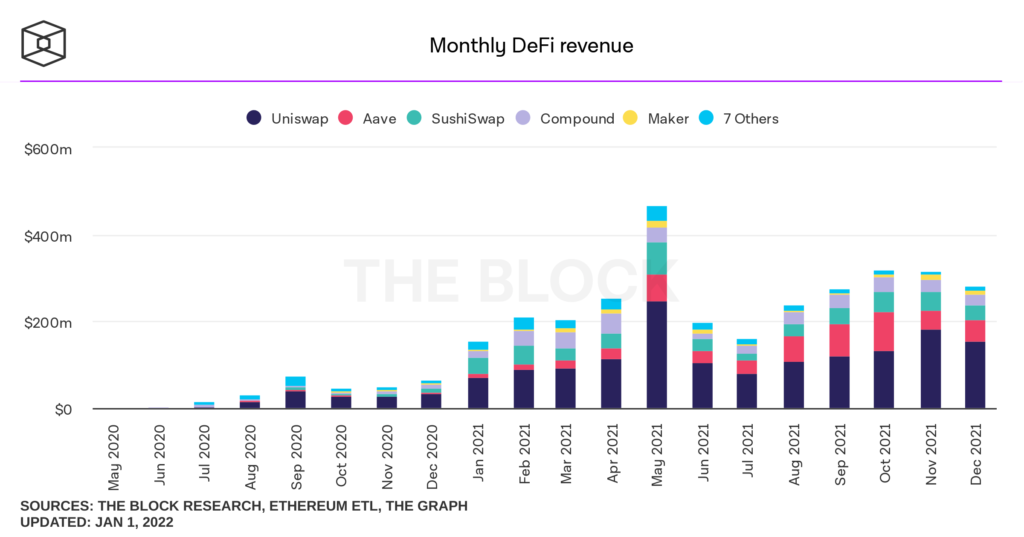

Cryptoncruting sectors and DEX remain the largest elements of an extensive Defi extractive system. The TVLs of both sectors remain high thanks to the constant influx of liquidity and a many value proposal that is understandable to many. However, despite growth, some indicators of activity on decentralized exchanges are somewhat inferior to peak May values.

Platforms of unlimited swaps and profitability optimizers are in significant demand. These sectors lead Dydx and Perpetual Protocol, as well as Convex and Yearn Finance, respectively.

There are the development of structured products, among which the profitability aggregators occupy a special place. It remains to find out how stable the liquidity of these complex platforms in the conditions of the bear market is.

Defi users witnessed the evolution of the emerging sectors, including liquid stake, MEV, instruments to ensure privacy. However, not in all areas there was growth – synthetic assets and insurance demonstrated stagnation against the background of an ascending general trend.

In 2021, various algorithmic stablecoins and "low -coching tokens" appeared. Not all of them managed to prove their vitality, which manifested itself in significant price fluctuations.

The demand for time -tested centralized stablecoins and tokenized bitcoins like WBTC continued to grow. This is a sign of the healthy growth of the Defi sector and the cryptocurrency market as a whole.